Like most industries, the energy and commodity trading markets are influenced by the transition to a renewable future, causing fundamental shifts and new developments in the way power traders and balance responsible parties work and function.

According to McKinsey & Company, the current transformation “will increase structural volatility, disrupt trade flows to open new arbitrages, redefine what it means to be a commodity, and fundamentally alter commercial relationships. All these developments will create unique opportunities and challenges for new and incumbent players alike.”

In this article, we dive into three factors that, in particular, contribute to the market changes we see in current years and explain how these intercorrelated changes both give rise to new opportunities and structural changes.

Decarbonization

The green movement and decarbonization are reshaping the energy market as more renewable assets are added to the power grid. The steep climb in renewable capacity has already gathered speed in recent years, and the outlook for the coming years suggests a future with a majority of fluctuating renewable energy sources combined with new storage solutions.

With the exponential development of renewable energy, market participants are expected to change accordingly. It is predicted that renewable asset owners, to a large extent, will begin to participate in the ancillary services market and submit bids for not only frequency control but also for the capacity markets.

Today, it is typically conventional energy sources like gas-fired power plants that participate in the capacity markets – but following the decarbonization of the industry, new participants like renewable assets and storage solutions will enter the market, too.

This movement is already beginning, and as more renewable plants are connected to the grid and connected to the capacity markets, the shift will intensify.

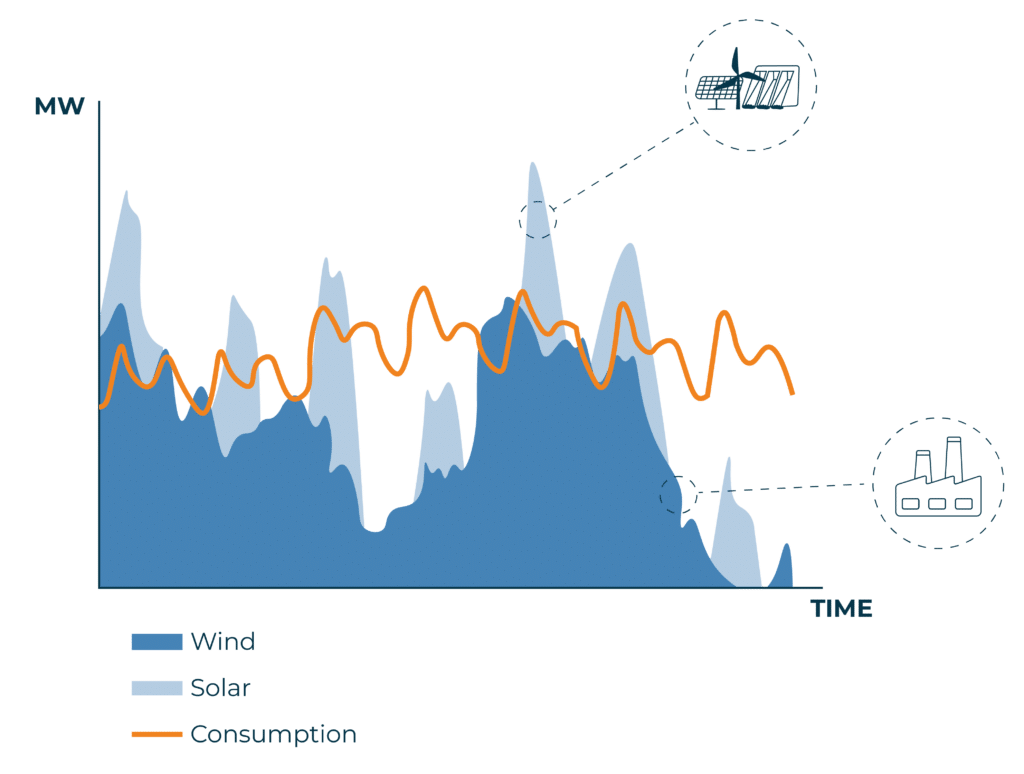

However, the shift also brings new challenges, as the fluctuating nature of renewables only allows renewable asset owners to participate in the market for down-regulation.

The illustration below explains how wind and solar assets are favorable for the ancillary markets in periods of high generation from renewable sources but not available in periods of low generation. In cases like these, conventional power plants, heat pumps, and batteries are more suitable assets to utilize in ensuring grid stability.

The fluctuations create two new demands for the players in the energy market. First, there is a need to ensure that the system's architecture is flexible and dynamic enough for the diversified technologies to coexist and be available for the right services.

Secondly, the new generating units need to be able to submit bids to the power exchange. This requires that power traders and balance responsible parties enable access for their customers and renewable portfolios, which typically involves new system integrations demanding unique expertise.

Digitalization

Another way the industry is evolving is in terms of technological advancements, which are also fostered by the movement toward a green future.

Digitalization is infiltrating various aspects of the energy trading business. And digitalization cannot be mentioned without also mentioning data.

The new and profound focus on data and advanced analytics is evident in the energy trading market in several areas.

Software like SCADA systems provides reliable and accurate data from power-generating sources, making real-time monitoring, remote control, and predictive maintenance of assets possible. This enables balance responsible parties to gain direct access to critical availability data from their portfolios for better and fast decision-making.

In the energy trading market, spreadsheets are being replaced with unified software systems that take care of the complex data collection from various systems through advanced communication protocols and smart algorithms. Balance responsible parties increasingly seek software (e.g., ETRM systems) to automate workflows and processes and thus reduce manual errors, workloads, and operational risks. The goal is to ensure system reliability and flexibility so that they can continue to offer their customers the best available deals.

And as more data become available, more processes will become automated, creating an optimal environment for power traders and balance responsible parties to generate cost savings and accelerate their business.

It is our prediction that we have only seen the beginning of how digitalization will transform the energy sector and trading markets.

Harmonization of energy markets

The trading landscape is also experiencing more structural transformations as trading markets become more globally interconnected.

A significant aspect of the EU‘s European Green Deal is the step toward an extended harmonized and flexible energy market, carried forward by an increased focus on European collaboration. The green movement and the rise of fluctuating energy sources push for new ways to secure grid stability in the future. This has so far contributed to new European market regulation schemes like the Manually Activated Reserves Initiative (MARI) and the Platform for the International Coordination of Automated Frequency Restoration and Stable System Operation (PICASSO).

These new cross-border energy platforms aim to enable a secure exchange of balancing energy across Europe and thus enhance the security of supply and energy independence.

The long-term goals of this integrated internal pan-European energy market are to ensure liquidity and competition in an open market and promote both green energy and efficient use of the available energy. Consumers should be offered more choices through transparent energy markets that guarantee fair and cost-reflective prices.

In that respect, the EU clearly advocates for consumers to also participate actively in the energy market. And with new active players for the demand-response side – and fluctuating sources on the other – system flexibility will become even more crucial in establishing a balance between affordability, decarbonization, and security of supply.

The ability to integrate different systems and technologies will be a key part of enabling this flexibility and harmonization and, at the same time, doing so in a reliable, fast, and efficient manner.